flow through entity irs

A flow-through entity is also called a pass-through entity. Log on to Michigan Treasury Online MTO to update.

Publicly Traded Partnerships Tax Treatment Of Investors

As a result only the individuals not the business are taxed.

. Any payments toward a flow-through entitys 2021 calendar tax year that are made after March 15 2022 will be claimed as a credit against members 2022 tax liability. Income that is or is deemed to be effectively connected with the conduct of a US. Flow-Through Entities Effects on FTC NOTE.

Trade or business of a flow-through entity is treated as paid to the entity. Although this flow-through entitys members. This Practice Unit is updated to reflect the recent finalized Treas.

Flow Through Entity means an entity that is treated as a partnership not taxable as a corporation a grantor trust or a disregarded entity for US. Participate Any rental without regard to whether or not the taxpayer materially participates A single entity. This disconnect between receipt of cash and reporting of income can result in hardship from having to pay tax on money you did not get.

Income Tax Accounting chapter 8 Flow-through entities. A flow-through entity is an entity through which income flows to the owners or investors without being subject to taxation at the entity level. Is designed to fulfill the scope and intended purpose of ensuring that tax on income is paid only once-collecting the same amount of income tax from the business entity as would otherwise.

Its gains and losses are allocated. October 31 2022 Full-Time Looking to work at a. You are a member of or investor in a flow-through entity if you own shares or units of or an interest in one of the following.

What is a flow-through entity. About Form W-8 IMY Certificate of Foreign Intermediary Foreign Flow-Through Entity or Certain US. Flow-Through Entity Tax - Ask A Question.

The Form W-8IMY Certificate of Foreign Intermediary Foreign Flow-Through Entity or Certain US. Federal income tax purposes or subject to. Passive Activity A trade or business in which.

A flow-through entity is a business in which income is passed straight to its shareholders owners or investors. Flow-through entities FTEs affect an individuals Foreign Tax. Rules for Flow-Through Entities.

2021 Flow-Through Entity FTE annual return payments must be made timely to avoid penalty and interest. A foreign partnership other than a withholding foreign partnership See more. A flow-through entity FTE is a legal entity where income flows through to investors or owners.

Flow-through entity income is reported by the entitys principals and tax paid on it regardless of whether any cash is distributed. For example a flow-through entity that elects into tax year 2021 on March 31 2022 pays all tax due for the year on that date. That is the income of the entity is treated as the income of the investors or owners.

The most common type of flow-through entity is. A flow-through entity is a foreign partnership other than a withholding foreign partnership a foreign simple or foreign grantor trust other than a withholding foreign. WithumSmithBrown New York NY.

All of the following are flow-through entities. Branches for United States Tax Withholding and Reporting This form may. Back to Jobs.

Branches for United States Tax Withholding provided by a foreign. Tax Senior Associate - Flow Through Entities. However the late filing of 2021 FTE returns will be.

A legitimate business entity that passes income to owners or investors of the business is a flow-Through entity. A flow-through is a business entity that may generate or receive taxable income but which pays no income tax in its own right. The principals can make a provision requiring that sufficient.

Irs Filing Requirements For Check Book Ira

The Pass Through Entity Tax A Salt Limitation Workaround Marcum Llp Accountants And Advisors

Do I Qualify For The Qualified Business Income Qbi Deduction Alloy Silverstein

1 1 24 Large Business And International Division Internal Revenue Service

Can You Switch To A Substitute Irs Form W 8

What Is A Pass Through Entity Definition Meaning Example

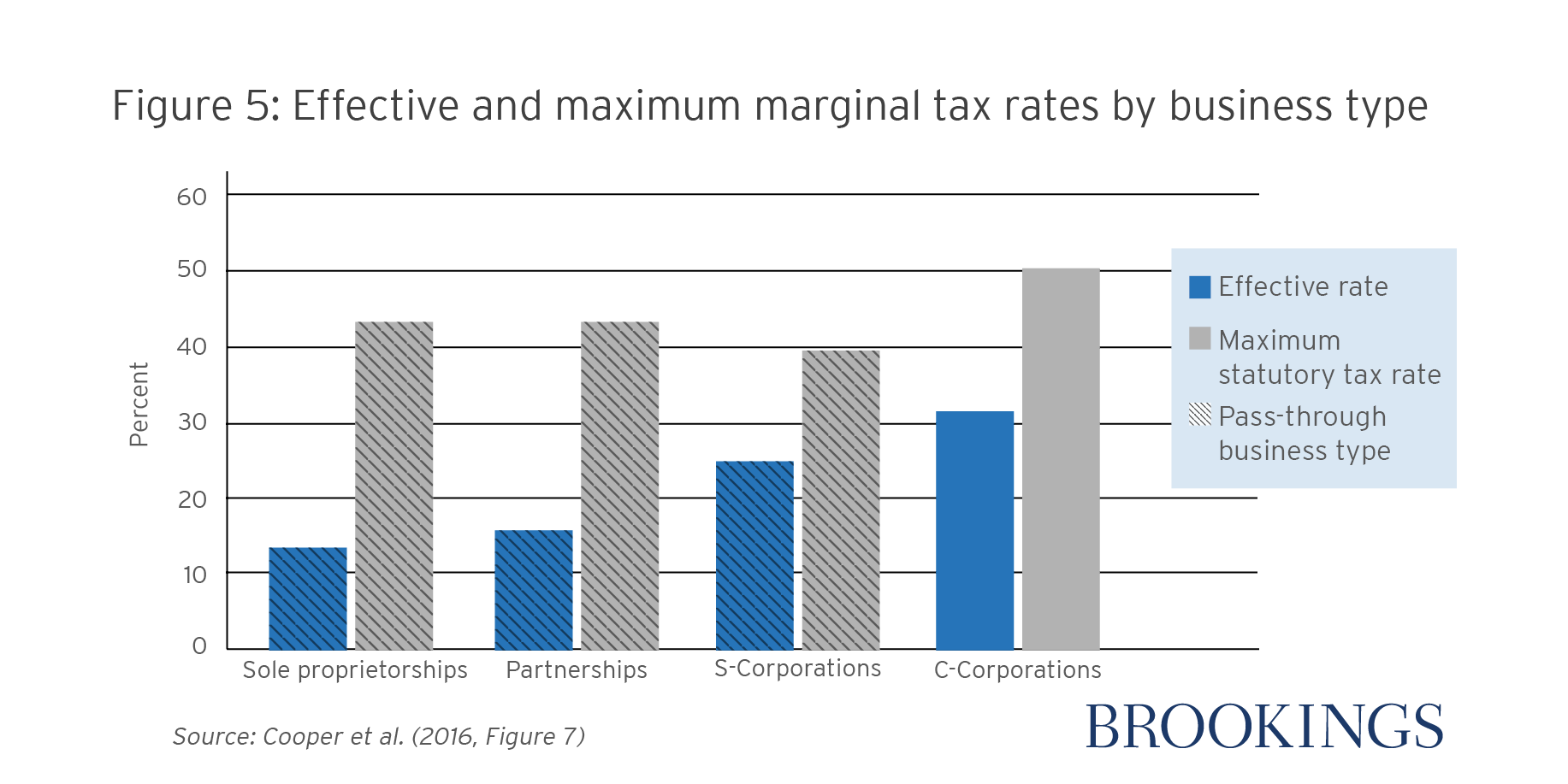

9 Facts About Pass Through Businesses

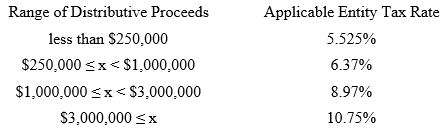

Pass Through Entity Salt Cap Workaround Lancaster Cpa Firm

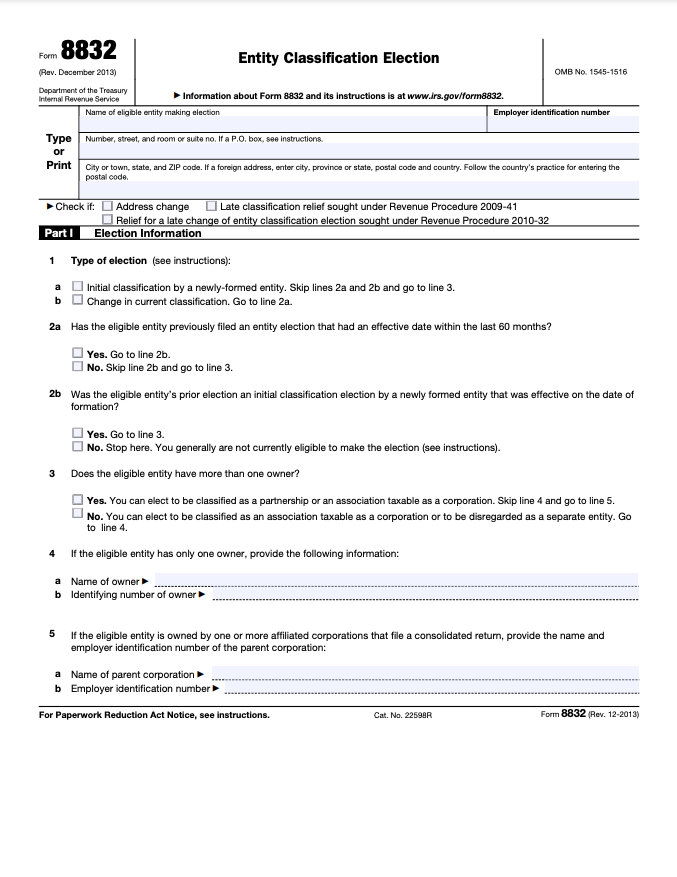

Llc Taxed As C Corp Form 8832 Pros And Cons Llcu

What Is A Disregarded Entity And How Are They Taxed Ask Gusto

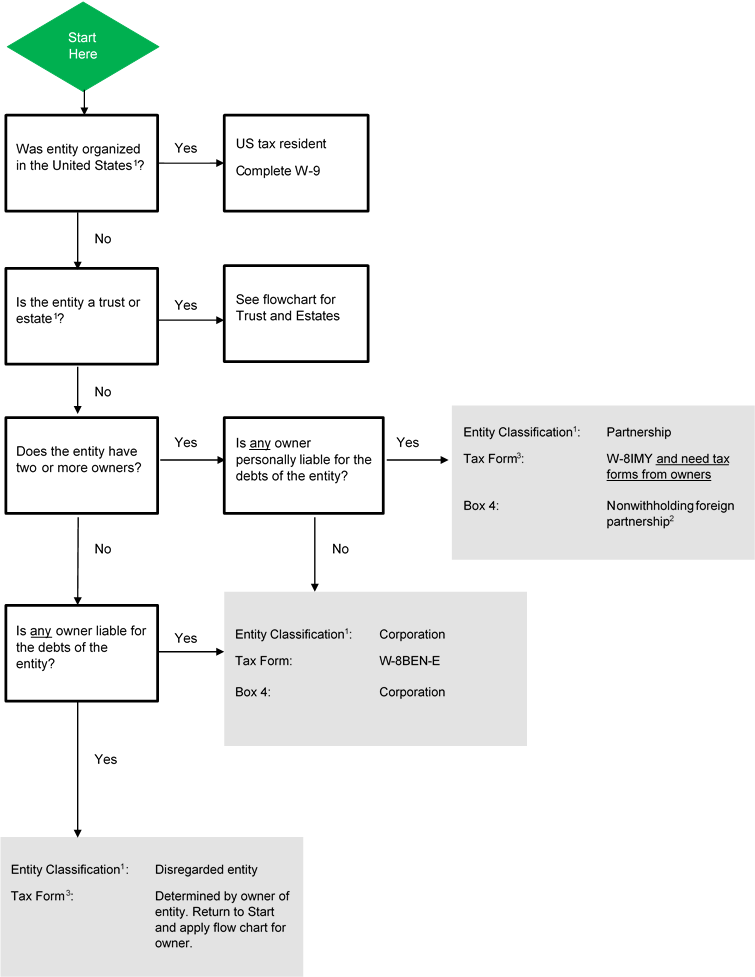

Entity And Fatca Classification For Non Financial Entities Ib Knowledge Base

9 Facts About Pass Through Businesses

Pass Through Entity Tax 101 Baker Tilly

Elective Pass Through Entity Tax Wolters Kluwer

Irs Allows Use Of Pass Through Business Alternative Taxes To Bypass 2017 Tax Act S Limitation On Salt Deductions Effectively Blessing New Jersey Statutory Work Around Gibbons Law Alert

Tax Effecting And The Valuation Of Pass Through Entities The Cpa Journal

How To File S Corp Taxes Maximize Deductions White Coat Investor

Form 8832 And Changing Your Llc Tax Status Bench Accounting

The California Elective Pass Through Entity Tax Provides Business Owners A Salt Cap Tax Credit Workaround